CBAM: The New EU’s Sustainability Regulation

And how to prepare your business for it

And how to prepare your business for it

6 min read

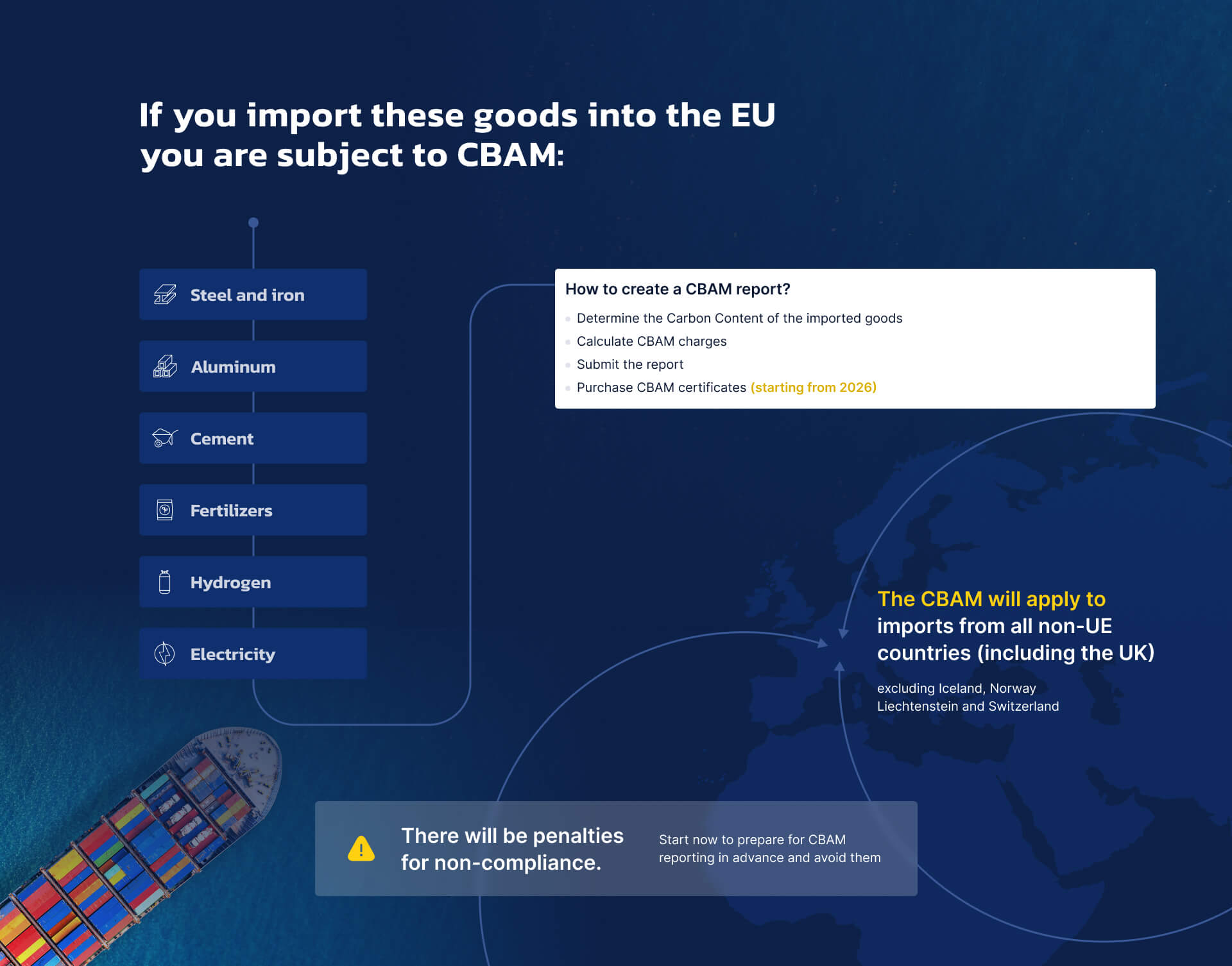

Do you import steel, iron, aluminum, cement, fertilizers, electricity or hydrogen into the EU?

Then you are subject to CBAM—the new European Union’s sustainability regulation. It’s already in force and will soon carry fines for non-compliance. This article will help you understand what CBAM is, what are its reporting requirements and how to comply with them.

European Union adopted CBAM to prevent carbon leakage, which occurs when industries relocate to regions with laxer environmental regulations to avoid the costs of emissions reduction measures.

CBAM ensures that the carbon footprint of imported goods is accounted for in the same way as for goods produced within the EU. Thus, the initiative levels the playing field for EU producers who are subject to stringent carbon pricing policies.

CBAM operates on a reporting and certification principle. Companies that import goods covered by CBAM must calculate and report the embedded carbon emissions of these products. Then they need to buy corresponding CBAM certificates to cover the reported emissions.

CBAM demands quarterly reporting with the deadline being the last day of the following month. This means that so far, four reporting periods (Q4 2023 - Q3 2024) have already been completed.

Here’s a simplified step-by-step process for CBAM reporting:

Determine the Carbon Content of the imported goods. Identify the amount of carbon dioxide emissions associated with the production of your goods. Currently, there are three approaches to this:

(DEFAULT VALUES FOR THE TRANSITIONAL PERIOD OF THE CBAM)

As of 1 January 2025, only the EU method will be accepted. It demands obtaining real data on embedded carbon directly from your suppliers according to the calculation and communication template.

Calculate CBAM Charges. Multiply the carbon content of your goods by the current EU carbon price to determine the CBAM charge (certificates). The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

Submit the report. Prepare a CBAM report that includes detailed calculations and submit it to the relevant EU authorities.

Purchase CBAM certificates. Buy the required CBAM certificates to cover the reported emissions. These certificates are similar to carbon credits and can be purchased through the EU system. If importers can prove that a carbon price has already been paid during the production of the imported goods, the corresponding amount can be deducted (starts from 2026).

1) On 1 October 2023, the CBAM entered into application in its transitional phase. This means that reporting became mandatory, but there is no obligation yet to buy the certificates. There are also no fines for ignoring reporting yet.

“The gradual phasing in of CBAM allows for a careful, predictable and proportionate transition for EU and non-EU businesses, as well as for public authorities” says the EU’s taxation and customs office.

2) In 2026, CBAM is entering the definitive mode. From then on, all importers will not only be required to report the amount of embedded carbon but also buy CBAM certificates equivalent to the carbon price of EU-produced goods. Those importers who will neglect these procedures will face sanctions and penalties from the authorities.

Making changes in a company (especially those big as CBAM demands) may not be easy, we perfectly understand this. And the CBAM’s definitive mode still being 1.5 years away may instill the reluctance to report today. But this approach isn’t right.

Let’s imagine the two scenarios:

1) Postponed Compliance. A company waits until CBAM enters the definitive mode to start reporting. It then scrambles to gather necessary data, engage suppliers, and understand reporting requirements. This rushed approach leads to mistakes, non-compliance, and fines.

2) Proactive Compliance. Another company starts now, using the time to trial and refine their reporting processes without any financial losses. By 2026, this company has a well-established system, experienced staff, and solid suppliers reporting flow, ensuring smooth, penalty-free compliance.

As you can see, the fact that CBAM reporting requires considerable effort and organizational shift exactly makes it imperative to start now. Introducing all these changes and engaging your suppliers will take some time. And starting now, you will have a chance to spend it before the fines for non-compliance hit (that’s exactly what the transitional period is for).

There was a lot of information in this article. Engaging suppliers, requesting their emissions data, interpreting that giant calculation & communication template Excel file, tracking EU ETC prices, calculating compensation charges… All of this may indeed seem like too much, we understand this. And it also requires some specialized knowledge to do.

If you don’t have it, that’s exactly why we’re here—to bring it to you. As experts in sustainability, we have the needed knowledge, tools and facilities to streamline and simplify your preparation to CBAM to the maximum. Sustainability is our job, so every day we ensure that we’re up-to-date with all the latest regulations and practices in this area.

For you, it translates to a shortcut directly to a result without all the preparation hassle. We can help you with:

- Calculating CBAM emissions using the equivalent method now while you prepare to request emissions from your suppliers;

- Supplier engagement, replacing manual processing of a gigantic Excel file each quarter with state-of-the-art technology, based on it;

- Calculating CBAM charges. You won't need to follow the auction EU ETS prices. We’ll take it upon ourselves, giving you just a final amount of CBAM certificates to buy;

- Resource optimization. Focus on what matters the most while we overtake sustainability.

Future-proof your business—talk to us today!